In Indonesia’s taxation system, PASAL 25 (Pajak Penghasilan Pasal 25, abbreviated as PPh Pasal 25) is an integral part of corporate income tax. It provides a mechanism for companies to pay their income tax in monthly installments, reducing the financial burden of a single annual payment and ensuring steady tax revenue for the government. This article will explain PASAL 25, its scope, and its calculation method.

What is PASAL 25?

PPh Pasal 25 refers to the tax regulation under Article 25 of Indonesia’s Income Tax Law, requiring taxpayers to pay their estimated annual income tax in monthly installments. It applies to:

- Corporate taxpayers (Badan Usaha), including limited liability companies (PT), cooperatives, and other business entities.

- Individual taxpayers (Wajib Pajak Orang Pribadi) whose income meets the taxable threshold.

PASAL 25 serves as a prepayment towards the final annual income tax liability (PPh Pasal 29), alleviating the financial burden during the annual tax return process.

How is PASAL 25 Calculated?

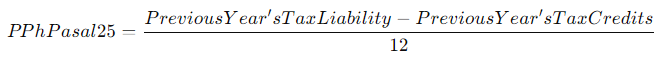

The monthly installments for PASAL 25 are based on the previous year’s tax filings, using the following formula:

Where:

- Previous Year’s Tax Liability: The total income tax payable reported in the previous year’s tax return (PPh Pasal 29).

- Previous Year’s Tax Credits: Tax amounts already paid through withholding taxes such as PPh Pasal 21 (employee income tax), PPh Pasal 23 (withholding tax on specific transactions), and PPh Pasal 22 (prepaid tax for imports).

- 12: The number of months in a year, representing equal monthly installments.

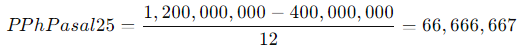

Example Calculation

Suppose a company’s total tax liability for 2023 was IDR 1,200,000,000, and it had already paid IDR 400,000,000 through PPh Pasal 21, PPh Pasal 23, and PPh Pasal 22. Its monthly PASAL 25 payment for 2024 would be:

Thus, the company would need to pay IDR 66,666,667 monthly as its PASAL 25 obligation in 2024.

Payment Procedure and Deadlines

Taxpayers are required to pay PASAL 25 by the 15th of each month, using the following steps:

- Generate a tax payment slip (SSP) through Indonesia’s online tax system (e-Billing).

- Complete the payment at designated banks or through online payment systems.

Timely payment of PASAL 25 avoids penalties and late payment fines.

Relation to Other Taxes

PASAL 25 operates as a prepayment mechanism linked to the final annual income tax (PPh Pasal 29). If the total prepaid tax exceeds the actual annual tax liability, the taxpayer can apply for a refund. Conversely, if the prepayments fall short, the taxpayer must pay the difference during the annual tax reconciliation process.

Conclusion

PASAL 25 is a critical component of Indonesia’s corporate tax framework. Proper planning and timely compliance with PASAL 25 obligations help businesses manage their tax burden effectively while avoiding penalties. Companies should ensure accurate calculations based on their previous year’s tax data to stay compliant with the law.